Dive into the intricate process of filling out your financial affidavit for divorce, where each detail holds the key to a successful settlement.

Zastic! 2024 Last Will and Testament Kit: Blank Legal Last Will Testament Forms, Do It Yourself Legal Will Maker Templates - End of Life Planning Kit - Includes 3 Blank Forms, Guide, & Envelopes

Amazon

Amazon

Amazon

Navigating the maze of financial disclosures during a divorce can feel like walking on a tightrope, balancing every detail meticulously. But fear not, as we break down the steps in filling out your financial affidavit to ease your burden.

From understanding the importance of accurate information to gathering the necessary documents, each section plays a crucial role in shaping the outcome of your divorce settlement. Hang tight as we guide you through the process, ensuring you are equipped to handle this aspect of your divorce proceedings with confidence and clarity.

When completing a financial affidavit for divorce, it's essential to have a clear understanding of what this document entails and its significance in the legal process. Financial affidavits provide a comprehensive overview of one's financial situation, including details such as income, expenses, assets, and debts. These documents are crucial in spousal support and child support cases, as they assist courts in making informed decisions regarding financial obligations. Accuracy in financial affidavits is paramount, as any discrepancies could impact the outcome of the divorce proceedings.

Properly filled out financial affidavits not only streamline the divorce process but also help businesses in assessing financial risks when making decisions on loans and other financial matters. It's important to note that the format of financial affidavits may vary by state, highlighting the need to adhere to specific guidelines to ensure compliance with local regulations. Understanding the nuances of financial affidavits is fundamental to presenting a clear and accurate representation of one's financial standing during divorce proceedings.

Ensuring the accuracy of information provided in a financial affidavit is paramount for facilitating a fair and just distribution of assets and income in divorce proceedings. Inaccurate or misleading information can have serious legal consequences, impacting the outcome of the divorce settlement.

To facilitate an accurate completion of the financial affidavit for divorce proceedings, it's essential to gather a comprehensive set of required documents. Start by collecting recent pay stubs to provide details on regular pay, bonuses, and any overtime earnings.

Additionally, gather documents such as tax returns and investment statements to outline all sources of income clearly. It's crucial to include records of monthly expenses, like utility bills, groceries, and other regular outlays, to present a complete picture of your financial situation.

AdvertisementDon't forget to compile information on assets such as real estate properties, vehicles, retirement accounts, and other valuable possessions to ensure transparency in your financial affidavits. Keeping all these required financial documents organized and easily accessible will streamline the process and help you accurately represent your financial standing during the divorce proceedings.

![]()

When compiling your financial affidavit for divorce, meticulous organization and adherence to detailed documentation are vital for a successful filing. Ensure all types of income, including regular pay, bonuses, investments, and any other income sources, are accurately reflected in your financial statements.

Itemize your expenses meticulously, covering essential bills like rent and utilities, as well as discretionary spending such as entertainment and dining out. It's crucial to support your financial information with important documents like pay stubs, tax returns, bank statements, and receipts to validate the accuracy of your average monthly income and expenses.

Avoid underestimating income or overlooking significant expenses that could impact your financial decisions during the divorce process. Following state-specific guidelines for expenses will help you fill out your financial affidavit comprehensively, leading to a successful completion of your statement of net worth.

We gather financial details meticulously, ensuring accurate income, expenses, assets, and debts are documented. This process is critical in divorce proceedings to secure fair distribution. Our goal is to provide the court with precise information for informed decisions.

A financial affidavit, or 'Declaración Jurada de Finanzas', is a crucial document in divorce proceedings. It discloses income, assets, debts, and more. Accuracy is paramount; even small errors can have serious consequences, impacting support and property division.

AdvertisementWe gather and organize monthly income, expenses, debts, and assets for accurate financial disclosure in Ohio divorces. Utilize specific court forms to outline income sources, deductions, and essential expenses. Document income sources with pay stubs, tax returns, and investment income.

Understanding the value of our interest is crucial in divorce. It reflects the monetary worth of assets we have a stake in, like real estate or investments. Accurate disclosure is key to fair asset division.

In conclusion, mastering the art of filling out your financial affidavit for divorce is the key to unlocking the gates to a smooth and fair legal process.

By meticulously documenting every detail of your financial situation, you can confidently navigate the complexities of divorce proceedings with ease.

Remember, accuracy is your best ally in securing a favorable outcome.

AdvertisementSo grab those documents, dot your i's and cross your t's, and watch as the path to resolution unfolds before you.

Amazon

Amazon

Amazon

Understanding the financial implications of divorce can be daunting. Christopher, our Financial Strategist, makes it accessible and manageable. He offers strategic insights into financial planning, asset division, and budgeting during and after divorce. Christopher’s guidance is invaluable for anyone looking to navigate the financial challenges of divorce with confidence and clarity.

Related Topics:Exploring Financial Infidelity as Grounds for Divorce

Financial Recovery After Divorce: Expert Tips for Rebuilding Wealth

Continue Reading

Advertisement

Solving the mystery of hidden assets, valuation disputes, and fair outcomes, financial investigators are essential players in shaping divorce settlements.

Financial Services Revolution: How Blockchain is Transforming Money, Markets, and Banking (Blockchain Research Institute Enterprise Series)

Amazon

Amazon

Amazon

As financial investigators, we play a crucial role in establishing financial clarity amidst the turbulent process of divorce proceedings.

The intricate web of financial intricacies that we unravel can make or break the foundation of a divorce settlement.

Let's explore how these financial detectives navigate through the complex terrain of hidden assets, valuation disputes, and ensuring fair outcomes, shedding light on the critical role they play in shaping the financial landscape of divorce proceedings.

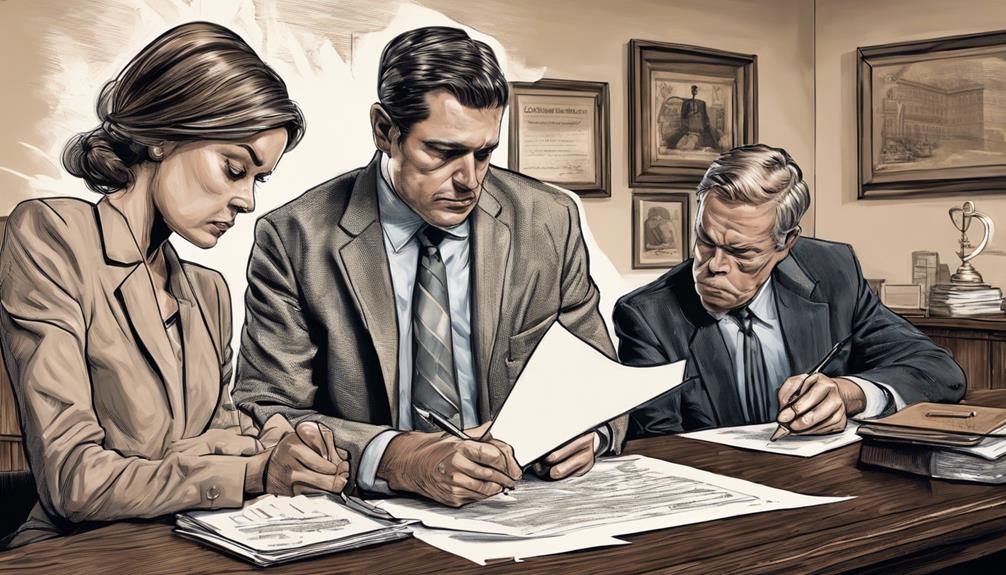

Financial investigators play a critical role in divorce cases by meticulously analyzing financial data to ensure an equitable division of assets. In the realm of divorce proceedings, distinguishing between community and separate property is crucial, and financial investigators excel in this task.

By evaluating business profits, investment earnings, and other financial aspects, they facilitate a fair asset division process. These professionals delve deep into tax records and spending patterns to uncover any hidden assets that could impact the settlement.

In high-net-worth divorces, their expertise in asset valuation becomes even more paramount, helping to accurately assess the true value of complex assets. Through their comprehensive appraisals of properties, investments, and other holdings, financial investigators contribute significantly to achieving equitable settlements that satisfy all parties involved.

AdvertisementTheir meticulous attention to detail and analytical approach ensure that the division of assets is done with precision and fairness, setting the stage for a smoother divorce process.

When delving into divorce cases, the meticulous work of forensic accountants proves essential in uncovering hidden assets through thorough examination of financial records and transactions. Forensic accountants are trained to sift through intricate financial data, leaving no stone unturned to reveal assets that may have been concealed deliberately.

They employ various techniques, like scrutinizing bank statements and invoices, to track down hidden assets camouflaged through deceptive means such as shell companies or secret accounts. Asset tracing is a vital process used by forensic accountants to trace the origin and fluctuations in the value of assets over time. This method is crucial for ensuring a fair asset division during divorce proceedings.

In asset valuation during divorce cases, forensic accountants play a crucial role in determining the accurate worth of all marital property items. They specialize in evaluating complex assets like businesses or investments, ensuring a fair division of property between the involved parties. Through their expertise, forensic accountants contribute significantly to establishing the financial settlement during divorce proceedings.

By engaging with forensic accountants, all assets undergo proper assessment and are included in the valuation process, leaving no room for oversight. This meticulous approach to asset valuation not only aids in preventing disputes but also minimizes the likelihood of dissatisfaction with the final division of property.

The involvement of forensic accountants in the valuation process adds a layer of assurance that the marital property is valued correctly, enabling a smoother and more equitable resolution of asset division in divorce cases.

Advertisement equitable distribution of assets" width="1006" height="575" />

equitable distribution of assets" width="1006" height="575" />

Transitioning from the critical role of forensic accountants in asset valuation during divorce cases, ensuring equitable asset division demands meticulous scrutiny of financial records and thorough analysis of diverse assets. Financial investigators play a pivotal role in uncovering hidden assets and income sources, ensuring a fair distribution of wealth.

By delving into financial records, tax returns, and business documents, they accurately assess the value of assets, including real estate, investments, and offshore holdings. Their expertise in business valuation is instrumental in determining spousal and child support payments by revealing undisclosed financial resources and hidden income streams.

Through close collaboration with divorce attorneys, financial investigators strategically gather essential evidence and financial information vital for divorce cases. This partnership is instrumental in uncovering hidden assets, analyzing financial records, and providing expert testimony in court.

By working together, financial investigators and divorce attorneys ensure a comprehensive approach to financial investigation, leading to fair asset division and support payment determinations. This collaboration strengthens legal arguments and enhances the client's position in divorce proceedings, particularly in complex cases where expertise from both parties is crucial.

The combined efforts of financial investigators and divorce attorneys maximize the chances of achieving favorable outcomes for clients by utilizing a tailored approach to evidence gathering and legal strategy. In essence, this collaboration is a cornerstone in navigating the intricate landscape of divorce cases, ensuring that all financial aspects are thoroughly examined and addressed for the benefit of the client.

We analyze financial data meticulously, uncovering hidden assets and income sources. Our expertise lies in scrutinizing documents like tax returns and business records for transparency. This role is pivotal in asset valuation and fair division planning.

AdvertisementIn divorce cases, forensic accountants analyze financial data, ensure accurate asset valuation, and provide expert testimony. They uncover hidden assets, promote transparency, and address complex financial matters. Their role is crucial in facilitating fair asset division.

We've found that private investigator costs in Texas vary from $50 to $250 per hour, depending on the complexity of the task. Additional expenses like travel and equipment may also be included in the total cost.

To excel as a financial crime investigator, one needs strong analytical skills for interpreting complex financial data, a deep understanding of financial laws, proficiency in investigation tools, attention to detail, and excellent communication skills for presenting findings effectively.

A forensic financial investigator in divorce can help uncover hidden assets, income, or financial discrepancies. By conducting a thorough analysis of financial records and transactions, they can provide valuable evidence to support their client’s case. Their expertise can be crucial in ensuring a fair and equitable division of assets during divorce proceedings.

In conclusion, financial investigators are the Sherlock Holmes of divorce cases, diligently uncovering hidden assets and ensuring fair asset division. Their meticulous analysis and expertise are crucial in navigating complex financial landscapes and securing just outcomes.

AdvertisementLike skilled detectives, they piece together financial puzzles with precision and dedication, ultimately shedding light on the truth and bringing clarity to often murky financial situations. Their role is indispensable in the pursuit of justice and equity in divorce proceedings.

Financial Services Revolution: How Blockchain is Transforming Money, Markets, and Banking (Blockchain Research Institute Enterprise Series)

Amazon

Operational Risk Management in Financial Services: A Practical Guide to Establishing Effective Solutions

Amazon

Amazon

Understanding the financial implications of divorce can be daunting. Christopher, our Financial Strategist, makes it accessible and manageable. He offers strategic insights into financial planning, asset division, and budgeting during and after divorce. Christopher’s guidance is invaluable for anyone looking to navigate the financial challenges of divorce with confidence and clarity.

Are you curious about the consequences of not setting a financial settlement time limit after divorce? Discover the intricate process and essential factors to consider.

Amazon

Amazon

Amazon

Let’s start by considering this idea: Have you ever thought about the potential consequences of not establishing a deadline for a financial agreement following a divorce?

The process of setting such a boundary can be intricate, but it is essential for ensuring a clear and defined path forward for both parties involved.

By exploring the various factors that come into play when determining these limits, we can gain valuable insights into how to navigate this aspect of post-divorce financial management successfully.

Setting a financial settlement time limit after divorce is crucial for ensuring a timely resolution of financial matters and preventing potential future disputes. In property settlement proceedings, establishing a specific timeframe within which financial matters must be settled helps in avoiding prolonged uncertainty and ongoing legal battles. Without a set time limit, ex-spouses may delay negotiations or seek to reopen financial settlements, leading to extended legal disputes and financial instability.

By imposing a time limit, both parties are encouraged to engage in timely negotiations, facilitating a quicker resolution and enabling individuals to move forward with their financial plans post-divorce. This structured approach promotes closure, minimizes the risk of future claims, and allows for a smoother transition into the next chapter of each person's life.

Ultimately, setting a time limit for financial settlement post-divorce is essential in providing clarity, certainty, and a sense of finality to all parties involved.

Advertisement

Considering the importance of timely resolution in financial matters post-divorce, it becomes imperative to assess various factors that play a significant role in determining the appropriate limits for settlement.

Firstly, the complexity of family dynamics and the intricacies of property settlement must be taken into account. Each family's situation is unique, requiring a tailored approach to establish a reasonable timeframe.

Secondly, the legal requirements for the application for property settlement should guide the decision-making process. Understanding the specific deadlines and procedures involved in property settlement applications is crucial to avoid unnecessary delays.

Additionally, the potential implications of missing the statutory time limit of 12 months after divorce for financial settlements shouldn't be underestimated. Delays can jeopardize property division rights and may impact spousal maintenance entitlements.

Seeking legal advice early on can provide clarity on these matters and help protect one's financial interests during the settlement process.

When establishing a time limit for reaching a financial settlement after divorce, it is crucial to carefully consider the personal circumstances and agreements to determine the desired timeframe. Consulting with a family lawyer specializing in family law can provide valuable insights into the legal requirements and options available for setting a time limit for the financial settlement. Factors such as asset division, spousal maintenance, child support, and other financial obligations should all be taken into account when establishing the time limit to ensure a fair and equitable outcome. One effective way to formalize the agreed-upon time frame is by drafting a formal agreement or consent order that explicitly states the deadline for completing the financial settlement post-divorce. This document becomes legally binding and can help prevent misunderstandings or disputes in the future. It is essential to ensure clarity and mutual understanding between parties regarding the consequences of not meeting the set time limit for financial settlement.

Advertisement| Family Law ConsultationLegal Requirements for Time LimitDraft Formal Agreement | ||

|---|---|---|

| Consider Personal Circumstances | Asset Division and Financial Obligations | Ensure Clarity and Understanding |

| Consult with Family Lawyer | Spousal Maintenance and Child Support | Prevent Disputes and Misunderstandings |

Effective communication strategies play a vital role in facilitating agreement on financial matters during the divorce settlement process. Parties involved in a divorce can benefit significantly from clear and concise discussions regarding their financial settlement agreement.

Seeking professional mediation services can provide a structured environment for constructive dialogue and help navigate complex financial issues efficiently. Utilizing written proposals and documentation can assist in clarifying terms and ensuring mutual understanding between both parties.

Regular updates and follow-ups on negotiations are essential to maintain momentum towards reaching a timely financial settlement.

Failing to establish a time limit for financial settlement post-divorce can result in prolonged uncertainty and potential financial risks, leading to disputes over assets, liabilities, and ongoing financial responsibilities. Without a clear deadline, ex-spouses may procrastinate or avoid finalizing the financial aspects of their divorce, which can lead to increased stress and legal complications. This lack of clarity can also impact financial planning, property division, and overall stability after divorce. Moreover, not setting a time limit can hinder the closure needed to move forward with financial independence. To illustrate the consequences further, consider the following table:

| Consequences of Not Setting a Time Limit | ||

|---|---|---|

| Prolonged Uncertainty | Potential Financial Risks | Disputes Over Assets |

| Disputes Over Liabilities | Ongoing Financial Responsibilities |

In essence, failing to establish a time limit for financial settlement post-divorce can have detrimental effects on both parties, potentially leading to court involvement and prolonged legal proceedings.

After divorce, financial outcomes vary depending on factors like earning potential, assets, and agreements made during marriage. The spouse with higher income or assets may fare better financially. Seeking legal advice is vital for a fair settlement.

AdvertisementAfter divorce, we manage finances by creating a budget, seeking financial advice, updating accounts, understanding obligations, and keeping records. These steps ensure financial stability and legal compliance. It's crucial to stay organized and proactive in managing post-divorce finances.

In Texas, no specific statute of limitations for divorce settlements exists. Parties can negotiate financial matters post-divorce without time constraints. If no agreement is reached, court intervention may be needed. Seeking legal advice is recommended.

We can't predict if your ex-wife can claim inheritance post-divorce. Legal advice is crucial. Inheritance's treatment varies. Seek guidance from a family lawyer. Understand the nuances. Protect your assets. Your future matters.

When going through a divorce, it’s essential to adhere to financial settlement time limits. The process for setting a time limit for financial settlement after divorce involves legally filing for the settlement within the specified timeframe. It’s crucial to consult with a lawyer to ensure all deadlines are met.

In conclusion, it's essential to set a financial settlement time limit after divorce to avoid future complications and protect your assets.

AdvertisementFor example, a couple who didn't establish a time limit faced a legal battle years later when one party tried to claim a portion of the other's inheritance.

By proactively setting a time limit and resolving financial issues promptly, you can ensure a smoother transition post-divorce and safeguard your financial interests.

Amazon

Amazon

Adjusted and Resilient Kids from Little" />

Adjusted and Resilient Kids from Little" />

The Co-Parenting Handbook: Raising Well-Adjusted and Resilient Kids from Little Ones to Young Adults through Divorce or Separation

Amazon

Understanding the financial implications of divorce can be daunting. Christopher, our Financial Strategist, makes it accessible and manageable. He offers strategic insights into financial planning, asset division, and budgeting during and after divorce. Christopher’s guidance is invaluable for anyone looking to navigate the financial challenges of divorce with confidence and clarity.

Stirring up curiosity, discover the surprising benefits and strategic steps involved in getting a divorce on paper for financial reasons.

Amazon

Amazon

Amazon

As we navigate the complexities of modern life, unexpected solutions may arise to address financial challenges. Exploring the option of obtaining a legal separation for financial reasons could offer unique advantages.

By carefully considering the intricacies of this process, individuals can potentially unlock opportunities for financial optimization and security. Let's delve into the initial steps and considerations involved in this intriguing approach to managing financial affairs.

When considering the reasons for financial divorce, it's essential to evaluate the potential benefits and drawbacks that such a decision may entail. Financial divorce often involves intricate tax planning, retirement considerations, and asset division strategies.

By divorcing on paper for financial reasons, individuals seek to optimize their tax liabilities, gain eligibility for ACA subsidies, and enhance their retirement planning prospects. Understanding the healthcare implications, changes in insurance coverage, and tax consequences are critical components of the financial divorce decision-making process.

Moreover, long-term financial implications, including retirement account division and potential tax complications, play a pivotal role in shaping the financial landscape post-divorce. This strategic approach to financial divorce requires meticulous attention to detail and a comprehensive understanding of how each decision impacts one's overall financial well-being.

To fully grasp the implications of pursuing a divorce for financial reasons, one must carefully consider the legal aspects, including asset division, alimony, child support, and financial disclosure requirements. When filing for divorce, understanding the legal implications is crucial to ensure a fair and equitable outcome. Consulting a divorce attorney can provide valuable insights into navigating the complexities of asset division, determining alimony payments, establishing child support arrangements, and meeting financial disclosure requirements. Proper documentation and thorough presentation of financial data are essential for a smooth legal process. Evaluating the long-term financial impact of the divorce is key to making informed decisions that align with your financial goals. Below is a table summarizing the key legal considerations when seeking a divorce for financial reasons:

| Legal Implications | Considerations | Importance |

|---|---|---|

| Asset Division | Equitable distribution | Fair allocation |

| Alimony | Spousal support | Financial stability |

| Child Support | Dependent care | Children's well-being |

Gathering personal and financial documentation, such as tax returns, asset details, and income information, is a crucial step in the divorce process. To ensure a smooth filing process, it's essential to complete the required forms accurately. Here are three key aspects to consider:

Advertisement

Safeguarding investments, real estate, and valuable possessions is a critical aspect of asset protection in divorce. Family law considerations play a significant role in determining how assets are divided during divorce proceedings. Understanding the tax implications of asset division is crucial for effective financial planning post-divorce. Retirement accounts, real estate holdings, and other assets need to be carefully evaluated to minimize tax liabilities and maximize financial gains.

Financial planning after divorce involves creating a structured budget, saving for the future, and managing assets wisely. Seeking guidance from a knowledgeable divorce lawyer or financial advisor can provide valuable insights into navigating the complexities of asset protection and financial planning. Spousal support arrangements should also be factored into long-term financial planning strategies to ensure financial stability for both parties post-divorce.

Effective asset protection and financial planning require a detailed inventory of all assets and liabilities to facilitate fair and equitable division during divorce proceedings. By proactively addressing asset protection and financial planning considerations, individuals can secure their financial well-being and plan for a stable future beyond divorce.

Getting a divorce on paper alone typically doesn't directly impact credit scores or financial standing. However, shared debts and assets during marriage might affect credit if not managed post-divorce. It's crucial to monitor and address these factors.

Tackling taxes post-financial divorce demands diligence. Divvying deductions, deciding on filing status, and discerning dependency exemptions are crucial. Seek sound advice to secure savings, sidestep surprises, and stay savvy in tax matters.

While getting a divorce on paper for financial reasons may offer short-term benefits, potential long-term consequences like affecting retirement savings, social security benefits, and estate planning should be carefully considered before making such a decision.

AdvertisementWhen considering post-financial divorce benefits like retirement or social security, it's crucial to understand the legal implications. We can navigate these complex matters effectively by seeking expert advice and ensuring our rights are protected.

There isn't a universal waiting period for a financial divorce to take effect; it varies by jurisdiction. It's crucial to consult legal counsel to ensure all necessary steps are followed accurately to expedite the process.

Getting a divorce for financial reasons may seem like a viable solution to alleviate the financial challenges of divorce. However, it’s important to consider the emotional and psychological toll it can have on individuals. Seeking financial counseling and exploring other options may be more beneficial in the long run.

In conclusion, divorcing for financial reasons can be a complex process that requires careful consideration and planning.

One interesting statistic to note is that according to a recent study, over 50% of divorces in the United States are at least partially motivated by financial issues.

AdvertisementThis highlights the significant impact that financial concerns can have on relationships and the importance of understanding the process involved in getting a divorce for financial reasons.

Amazon

Amazon

Amazon

Understanding the financial implications of divorce can be daunting. Christopher, our Financial Strategist, makes it accessible and manageable. He offers strategic insights into financial planning, asset division, and budgeting during and after divorce. Christopher’s guidance is invaluable for anyone looking to navigate the financial challenges of divorce with confidence and clarity.

Advertisement

Affiliate Disclaimer

As an affiliate, we may earn a commission from qualifying purchases. We get commissions for purchases made through links on this website from Amazon and other third parties.

Advertisement

Jump into a world of whimsical and stylish divorce party decor ideas that will elevate your celebration to the next.

Open up to a world of creative and empowering divorce party banners that will transform your celebration—find your perfect match.

Get ready to elevate your divorce party with the 15 best supplies that embody elegance and sophistication - are you.

Hunt for the ultimate divorce party decorations to help him celebrate his newfound freedom in style awaits - discover the.

Liberate yourself with the top divorce balloons for a whimsical and empowering celebration - find out how they can elevate.

Prepare to transform your divorce party with these 15 stylish decor ideas that will set the perfect ambiance - find.

Take your divorce party decorations to the next level with these empowering and stylish picks - find out how they.

Ignite your divorce party with these 15 stylish decorations for men, setting the perfect tone for a celebration like no.

Hoping to infuse your divorce party with style and flair?

Navigate the world of divorce gifts for women with these 14 empowering and thoughtful ideas that inspire strength and celebrate.

Advertisement

Coping Strategies 1 month agoThe information provided on https://howgetdivorce.com/ is for general informational purposes only. All content is offered on an "as is" basis and does not constitute legal, medical, or professional advice of any kind. It is not intended to be a substitute for professional consultation with a qualified attorney or healthcare professional. Users are advised to seek the advice of a licensed professional for any legal or medical concerns.

Limitation of Liability: The website and its content creators will not be liable for any direct, indirect, incidental, consequential, or special damages arising from the use of, or inability to use, the information provided. This limitation applies even if the website has been advised of the possibility of such damages.

Accuracy and Completeness: While efforts are made to ensure the reliability and timeliness of the information, we do not guarantee its accuracy, completeness, or currentness. Laws, regulations, and medical practices change frequently, and users should consult a professional who can provide advice tailored to their specific situation.

External Links Disclaimer: This website may contain links to external websites not owned or operated by us. We are not responsible for the accuracy, completeness, or reliability of any content on these external sites.

No Professional-Client Relationship: Interaction with the website or the use of information provided herein does not establish an attorney-client or healthcare provider-patient relationship.

Jurisdictional Issues: The information provided is intended to be applicable primarily within the United States. Users from other jurisdictions should be aware that the information may not be applicable or appropriate for their specific circumstances.

Contact Information for Further Inquiries: If you have any questions or need further information, please contact us through the available channels on our website. We encourage users to consult with a qualified professional for specific advice suited to their personal situation.

Date of Last Update: Please note that the content on this website, including this disclaimer, is subject to change and was last updated on 2024, April 1st. We recommend users to periodically review the disclaimer for any changes.